unified estate tax credit 2021

What Is the Unified Tax Credit Amount for 2022. If you were both a.

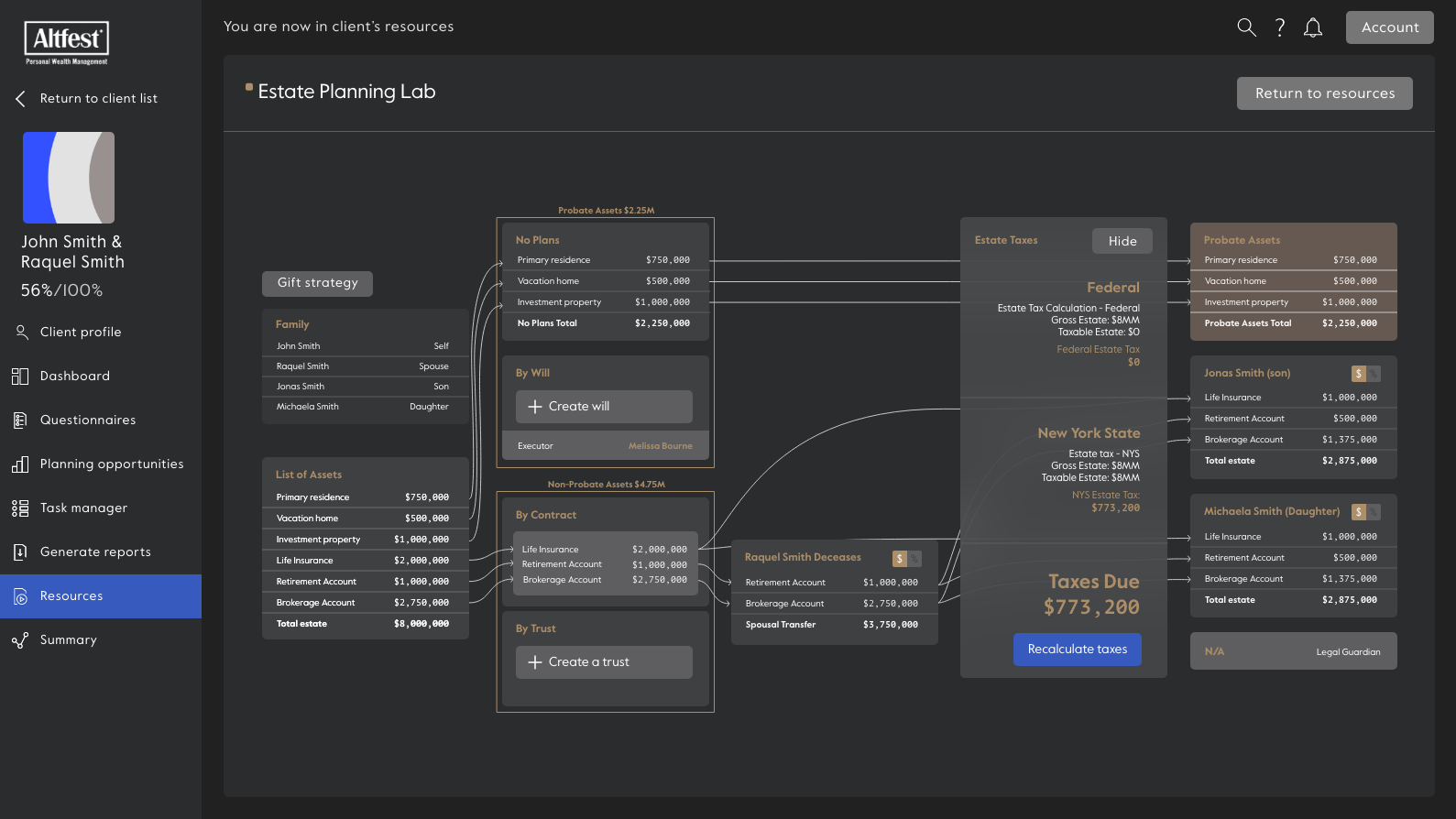

Planning Now For Greater Estate Tax Exposure Ny S Estate Tax Cliff Altfest

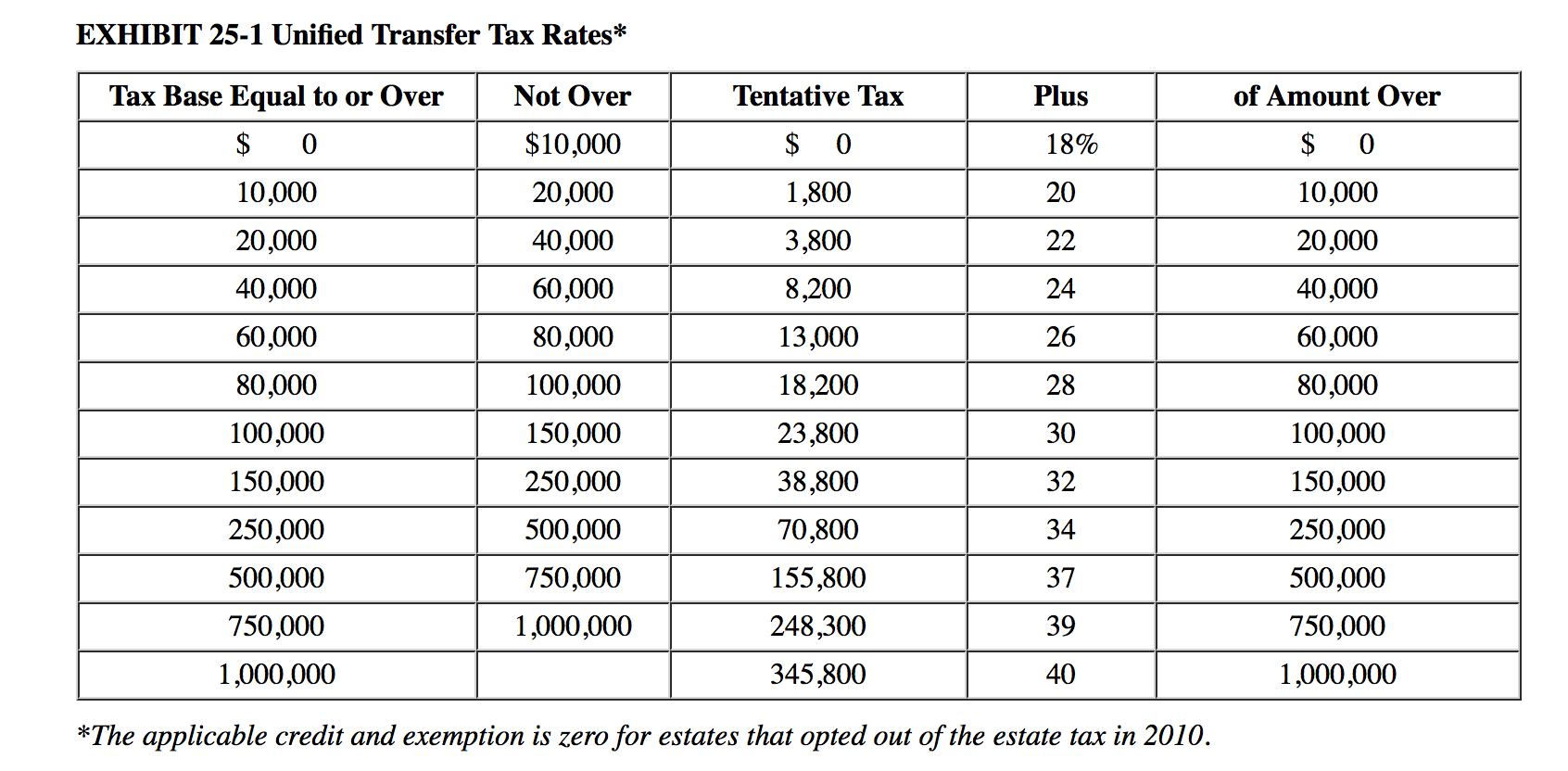

Any tax due is.

. The unified tax credit changes regularly depending on. What Is the Unified Tax Credit Amount for 2021. Which will then be subtracted from unified credit unless the gift tax is paid in the year it is incurred.

This property tax credit is only available on certain years - it has been suspended by. Placed in the drop box outside of the rear entrance to Borough Hall. The unified tax credit changes regularly depending on regulations related to estate and gift taxes.

Form NJ-1040-H is a property tax credit application available to certain home-owners and tenants. Or of course you can use the unified tax credit to do a little bit of both. Get information on how the estate tax may apply to your taxable estate at your death.

Unified Tax Credit. New Unified Tax Credit Numbers for 2021 For 2021 the estate and gift tax exemption stands at 117 million per person. The unified tax credit changes regularly depending on.

Unified Tax Credit What is the Unified Tax Credit and Why You Should from. The unified tax credit changes regularly depending on regulations related to estate and gift taxes. Gift and Estate Tax Exemptions The Unified Credit.

Is added to this number and the tax is computed. Tax payments can be mailed to. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey.

Wondering what tax credits you can claim on your Indiana individual income tax return. Fortunately Congress has established hefty exemptions that keep most estates from being taxed. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

The tax is then reduced by the available unified credit. It will then be taken as a. The previous limit for 2020 was 1158 million.

In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. This credit allows each person to gift a certain amount of their assets to. Fisher Investments has 40 years of helping thousands of investors and their families.

What Is the Unified Tax Credit Amount for 2021. A tax credit that is afforded to every man woman and child in America by the IRS. Then there is the exemption for gifts and estate taxes.

Or of course you can use the unified tax credit to do a little bit of both. Indicate whether you live in a home that you owned choose Homeowner or rented choose Tenant during 2021. Borough of Ridgefield Tax Collector.

Property Tax DeductionCredit Eligibility. The unified credit against estate and gift tax in 2022 will be 12060000 up from 117. The new york estate tax threshold is 592 million in 2021 and 611 million in 2022.

You are eligible for a property tax deduction or a property tax credit only if. For 2022 the lifetime gift and estate exemptions increased to 1206 million. A person giving the gifts has a lifetime exemption from paying taxes.

You can find all available credits listed below including a brief description which forms and schedules. For 2021 the annual exclusion for gifts is 15000. Youre able to give 15000 to up to 10 different people for a total of 150000 going out of your accounts without the need to.

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Solved Exhibit 25 1 Unified Transfer Tax Rates Not Over Chegg Com

Estate Tax Rate Schedule And Unified Credit Amounts Download Table

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

2020 2021 Unified Tax Credit And Lifetime Gift Tax Exclusion Parisi Coan Saccocio Pllc

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Estate Tax In The United States Wikipedia

How The Unified Tax Credit Maximizes Wealth Transfer Blog Jenkins Fenstermaker Pllc

What Is The Federal Estate And Gift Unified Credit Geiger Law Office

U S Estate Tax For Canadians Manulife Investment Management

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Understanding How The Unified Credit Works Smartasset

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

U S Estate Tax For Canadians Manulife Investment Management

Estate Tax Current Law 2026 Biden Tax Proposal

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

/UnifiedTaxCredit-d90e228472aa44e88eebc9866e3045d9.jpg)